Why rail modal shares are so low and what can he do to reverse it? 29/03/24

< Back to listLink: https://mediarail.wordpress.com/why-rail-modal-shares-are-so-low-and-what-can-he-do-to-reverse-it/

Author: Frédéric de Kemmeter

Article published: 22.10.23

Why rail modal shares are so low and what can he do to reverse it?

Rail freight in Europe suffered from a steady decline over several decades. The modal share of rail freight has decreased from a dominant 60 percent in the 1950s, and 30 percent in the 1970s, to as little as 15 percent in the 1990s. Why this decline and what can he do to reverse it?

Structure of the industry

The structure of industry has changed dramatically. In the past, the railways made their money by transporting coal, ore and steel products, the so-called heavy industry. This type of transport was perfectly suited to massification. But as we know, coal mines in Europe have closed and the steel industry has contracted. According Destatis, in Germany, the volume of coal, iron, and metal transported dropped by around 85 million tons between 1970 and 2017- representing a 60 percent drop in the volume of freight rail from all sectors in the country.

In the decades following the Second World War, much of the industry was transformed into smaller, more geographically dispersed factories. The result was that these factories did not fill a train or even a wagon every evening. What’s more, it became difficult to connect each dispersed factory, while at the same time rail lines were being closed around major cities. Contraction of volumes and dispersion of production sites have favoured road transport and put rail in a minority position.

This trend is unlikely to be reversed in the next few decades, particularly with the advent of e-commerce, which favours small consignments.

Freight market stable but in the minority

According Mc Kinsey, the European freight rail industry has seen a steady decline over the past 70 years. Freight rail’s modal share has decreased from around 60 percent in the 1950s, and 30 percent in the 1980s, to roughly 17 percent today. As recall the association ERFA, this loss of volume resulted in a vicious circle of an increasing proportion of fixed costs and operational losses, deteriorating competitiveness, and resulting in further loss of volume, and consequently increasing fixed costs proportion and operational losses again.

Freight rail’s modal share has decreased from around 60 percent in the 1950s to roughly 17 percent today

By contrast, road transport has been steadily increasing. In 1980, less than 50 percent of goods were transported by road. This rose to more than 75 percent by 2018.

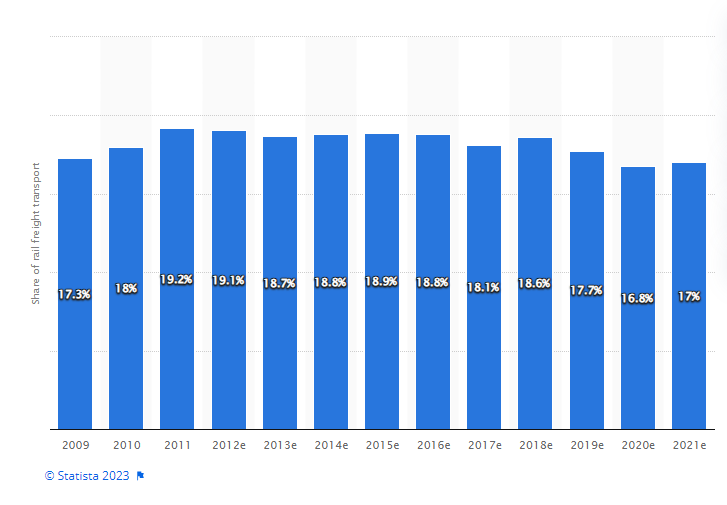

According the website Statista, the percentage of rail transport in total inland freight transport in the European Union saw no significant changes in 2021 in comparison to 2009 and remained at around 17 percent. However, over the observed period, the percentage of rail transport has been subject to fluctuation. There are indeed considerable differences between states: frontrunner Lithuania has a share of 64.7 percent, Greece a poor 3.2 percent. In Germany, Europe‘s largest economy, it was 17.6 percent in 2021.

Source: Statista

Structure of the rail freight transport

The railways’ transportation structure can be divided into different kind of trains that cover different market segments, which gives them different cost structures and quality characteristics.

Wagonload traffic comprises the transportation of whole wagons that are loaded and unloaded by the customers at industrial sidings or loading platforms. Wagonload traffic may be either single wagons or groups of wagons. The wagons are often shunted twice or more during their journey. The problem with this technique is that you often need a big, polluting diesel locomotive just to push or pull a few wagons. A lot of time is needed for shunting. A Swiss employee gave the example of a cargo service train that travelled from Thun to Zweisimmen (Berne region) just to bring and retrieve two wagons. The entire journey, 2 times 45 kilometers, took three hours.

A major problem is that these wagons, collected from all over a region, then have to be sorted and grouped together in an expensive facility called as ‘marshalling yard’. This wastes even more time, because the sorting time is added to the waiting time at departure. The result is a service where travelling 700 kilometres takes two days, if not three.

Alexandre Gallo, head of DB Cargo France, told a commission of enquiry in France that single wagonloads were structurally loss-making, citing a loss of €300 million in Germany alone. It is becoming clear that this type of transport is no longer profitable, and that only public subsidies can keep it alive.

Unit trains are block trains operated for a specific customer with dedicated wagons and according to their own timetable. These are trains that go directly from point A to point B without changing their composition. These trains are much more profitable and are the ones most commonly seen on the railways these days. The containers train is an emblematic example of the block train.

Intermodal transport uses rail on the main leg of the journey, generally the longest. The last few kilometres are carried out by trucks.

What are crucial determinants for freight transport mode choice?

To this question, the International Transport Forum (ITF) answers that freight transport could be considered an interlinked set of markets – the interplay of demand and supply – embedded in regulatory frameworks and other policy instruments (e.g. infrastructure fees and taxes). These instruments constrain to a more or lesser extent the market; they take certain public objectives into account that can make modal shift possible. The following three elements – the demand of shippers, the supply of transport infrastructure and the regulatory framework – constitute the main determinants for freight transport mode choice.

Truck transport is better positioned than rail in terms of cost, flexibility, and reach

According Mc Kinsey, today, truck transport is better positioned than rail in terms of cost, flexibility, and reach, but not in terms of pollution. However, truck transport is expected to gain a cost advantage of between 20 and 30 percent by 2050, given advances in driverless operations, flow optimization by advanced analytics, and fuel efficiency.

A DHL website explains that rail freight is not an option for spontaneous delivery requests, as its schedule-based operation makes it very inflexible. Rail infrastructure often does not match transportation demand, and freight rates are higher than for road freight.

What are the challenges facing rail freight?

Another DHL website mentions in particular that infrastructure in particular poses challenges for rail freight: each country has its own regulations and technical standards, which means that there is usually a stop at the border – and trains must be recoupled, or drivers replaced.

Individual national regulations and the lack of European standards further complicate more the situation. Although a uniform EU track width in Europe with 1,435 millimeters (from Trondheim to Catania or… Istambul), the Baltic states have 1,520 (a relic from the tsarist era!), and on the Iberian Peninsula 1,668 millimeters. But the real problem is the different national security systems, each with its own signals and signs. Signalling is not just about the colour of lights, but is also about train’s detection system on the network, something which is unknow on the road network where vehicles don’t need to detect.

When you read these different topics, you realise why rail has lost so much market share. Roads serve every company in Europe, which is not the case for rail infrastructure. A lorry turns around in a small factory yard and a single driver takes care of everything, including the transport documents. Greek truck drivers understand the traffic signs in Finland or Netherlands perfectly. Road transport is also competitive because its innovation cycles are much faster than those of rail.

Is rail definitively doomed? Certainly not…

Toward a better future?

There are grounds for hope. On the one hand, there is a new wind blowing about the climate and the decarbonization of transport, which accounts for 30% of total CO2 emissions, and which therefore demands a reversal of the trend. From a climate point of view, undeniably, rail freight offers great potential for emissions savings. Trains have suddenly become a desirable mode of transport once again, as a large proportion of Europe’s railroads are powered by electricity, unlike in Canada, Australia or the USA, for example.

However, as recall Mc Kinsey, given today’s preference for truck transport, the freight rail industry will need to undergo a major performance shift if it is to provide a competitive alternative. To make up for lost volumes, rail will need to grow seven times faster than road transport to reach the expected modal share of 30 percent. Is it faisible?

Undeniably, rail freight offers great potential for emissions savings

The liberalization of the railways in Europe has given rise to new players with other ideas for operating trains more rationally. A firm like Innofreight, for example, has invented a single wagon on which you can place whatever you want: a container, a tank or specially designed stanchions for timber.

In the past, forwarding and logistics companies were mainly focused on road transport or global air & sea freight transport. With the emergence and strong growth in the intermodal market, more and more forwarders started to leverage the benefits of this dual-mode transport solution. The result was the emergence of numerous transshipment yards. In several countries, the establishment of an industrial park is conditional on a compulsory connection to the rail network, as is the case in Italy with its Interporto. In many cases, these sites are designed for intermodal transport.

On another front, locomotives are becoming increasingly interoperable. In fact, manufacturers are building now only standard locomotives, to which national safety systems need only be added. When you build standard rolling stock, you simplify specifications and can sell in any European country. To get started, a small operator can now hire rather than buy. This allows you to start your business without too many fixed costs.

The digital issue is also of great importance. We don’t have to dream of autonomous trains, but we can start with simple things. For example, making the consignment note de facto electronic and no longer having to place a piece of paper on the carriage that is destroyed by the journey and the weather.

The same applies to freight wagon braking, which still relies on brake blocks applied to the wheel rims, which is very noisy and still causes the wheels to overheat. See the recent accident in the Gotthard tunnel…

An automatic coupling system is currently being tested throughout Europe, but its cost is likely to hold back even its greatest supporters.

But infrastructure managers will also have to rethink the way they operate a rail network. The priority given to passengers is due to the fact that this is a strong demand from politicians. Systematic timetables for freight trains should therefore be established, and capacity should be increased by revising signalling.

This requires a lot of money, but once it’s done, we’ll have a decent infrastructure for at least 2 or 3 decades. So it’s worth putting in a lot of money now to be able to put in less in the future…