Rail-sea rate competition to intensify 30/10/23

< Retour à la liste

Rail-sea rate competition to intensify even more in the coming years

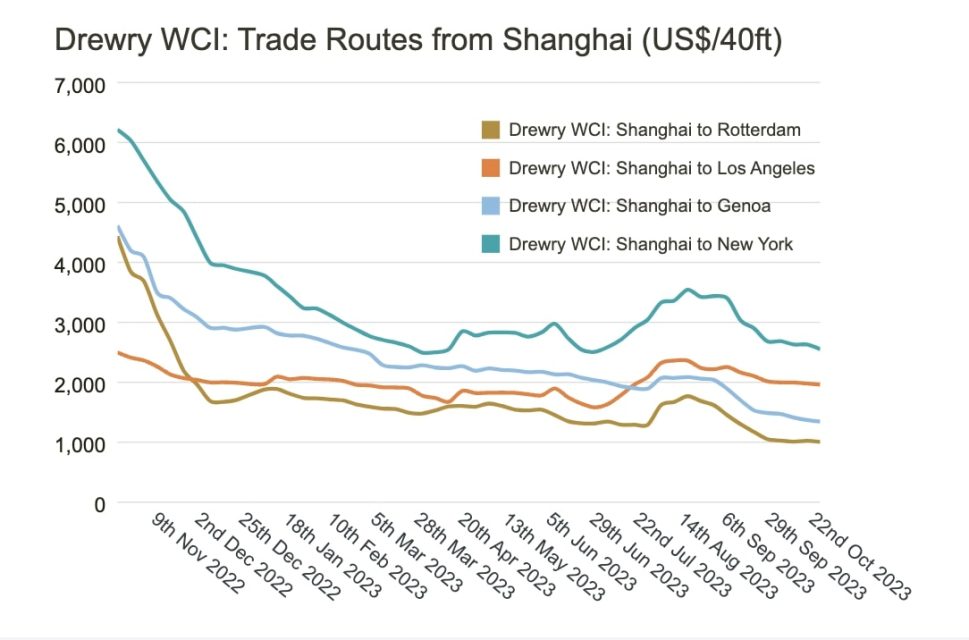

Sea shipping rates reached a new low last week, according to Drewery’s World Container Index, which saw a 2 per cent decrease to 1,342 US dollars per 40ft container. The rate was 57 per cent lower than the same week last year. Overall, in 2023, sea shipping rates have decreased by 60 per cent, increasing competition with intercontinental rail significantly. The situation could intensify even more in the coming years.

Simon Heany, Senior Manager of Container Research at Drewery and responsible for the latest report, explained that the reduced sea shipping rates will follow a similar course in 2024, with an expected additional drop of 33 per cent. As he analysed, the situation will not only characterise 2024 but “it will be repeated in the corresponding years too.”

The pricing situation strains even more Eurasian rail, which now has to compete with even lower sea rates than before. Accordingly, it appears that next year but also the years after it will be challenging in terms of balancing and competing with the significantly lower sea transport prices.

Rates development during the last year. Source: © Drewry World Container Index, Drewry Supply Chain Advisors.

Rates development during the last year. Source: © Drewry World Container Index, Drewry Supply Chain Advisors.

Supply-demand imbalance grows

In an interview with RailFreight.com a few months ago, Christian Roellofs, CEO of global trade and transport platform Container xChange, explained that the all-time low sea freight rates owed to the increasingly growing imbalance between supply and demand. “Trade has been significantly negative over the past few quarters because demand has just sort of cratered,” he explained.

Supply from the transport industry keeps growing, however. This creates another tricky puzzle that logistics companies need to solve. “Here you have the opposite picture,” said Roeloffs. “The fresh capacity entering the market creates an imbalance, and the only way to balance it is price,” he underlined. Besides vessel capacity, the transport market is also overflowing with available containers. “Depots, where containers are stored and repaired, overflow with empty boxes, and try to sell them out as fast as possible,” added Roeloffs.

Drewery’s report confirmed Roeloff’s comments since the forecast for next year shows that the industry supply will grow by 6,4 per cent while demand will grow only by 2 per cent. “We are talking about a muted market in general,” Simon Heany said.

A foreseen price war

One of Roellof’s remarks concerned the development of prices, which, according to him, would result in a price war. “Currently, 30 per cent of the existing fleet is on order books, so there’s an additional 30 per cent that’s just waiting to come online once the ships are produced, and that will just significantly worsen the supply-demand imbalance and will force carriers to accept rates that are actually below variable costs, where it doesn’t really make sense to move containers anymore. However, they’ll still do it to keep existing volumes and not allow their competitors to increase their market share. So I would expect a price war coming, so to speak,” he highlighted.

Those concerns are more or less reflected in Drewery’s latest report, considering that forecasts and estimations do not see the situation stabilising not only in 2024 but also in the consecutive years to come.